- Back to NEWS & VIEWS

- Press Releases

- 25/06/2025

UNEP Sustainable Blue Economy Finance Principles

Ocean 14 Capital Limited Disclosure June 2025

Introduction

Ocean 14 Capital is a signatory of the Sustainable Blue Economy (SBE) Principles. Ocean 14 Capital Fund I (O14C), as an impact fund that was established to invest in businesses with a positive impact on the oceans generally, and SDG14 specifically, believes our policies, practices, activities and investments are well-aligned with the SBE principles.

O14C is an Article 9 Fund under the EU Sustainable Finance Disclosure Regulation (SFDR), with the stated objective of contributing to the top four targets of SDG14, a commitment that all the fund’s investments are sustainable investments that do no significant harm, and the application of Minimum Safeguarding Standards. This further reinforces our alignment with the SBE Finance Principles.

Fund Objectives and Status

O14C’s investment strategy is to invest in equity and equity-like securities in growth companies, two thirds in Europe, with the overall aim of providing investors with a competitive return on capital, and to generate positive environmental impact that contributes to the UN Sustainable Development Goal 14 on “Life below water”.

O14C’s first SBE report was presented in May 2022, when no investments had been made. The focus had been on preparing impact investment strategy and developing processes and procedures for impact assessment and measurement to support the strategy. The Fund began deploying capital later in 2022, with four investments made during that year. A further six investments were made in 2023 and four in 2024.

Alignment with global agreements

Sustainable development goals

The fund has been explicitly set up to make quantifiable contributions to SDG14. We also deliberately seek to create positive impact for other SDGs and avoid negative (unintended) impacts.

Kunming Montreal Global Biodiversity Framework

The UN Finance initiative proposes the following three broad actions for investors:

- Integrate biodiversity into investment decision-making;

- Invest in innovative financial solutions to help mobilise the USD200bn/year needed to meet the GBF’s objective;

- Disclose nature-related dependencies, impacts, risks and opportunities.

As an ocean-focussed impact fund, we believe we are moving strongly on the first two actions. We are currently evaluating how we can engage with TNFD. We aim to be able to disclose on nature related dependencies and impacts, and on the associated risks and opportunities, across our portfolio by the end of 2025.

Paris Agreement Alignment

Most of the fund’s asset allocation to date is in companies which have a direct or indirect GHG mitigation contribution. The fund’s assets do not yet have science-based targets to ensure alignment with the Paris Agreement.

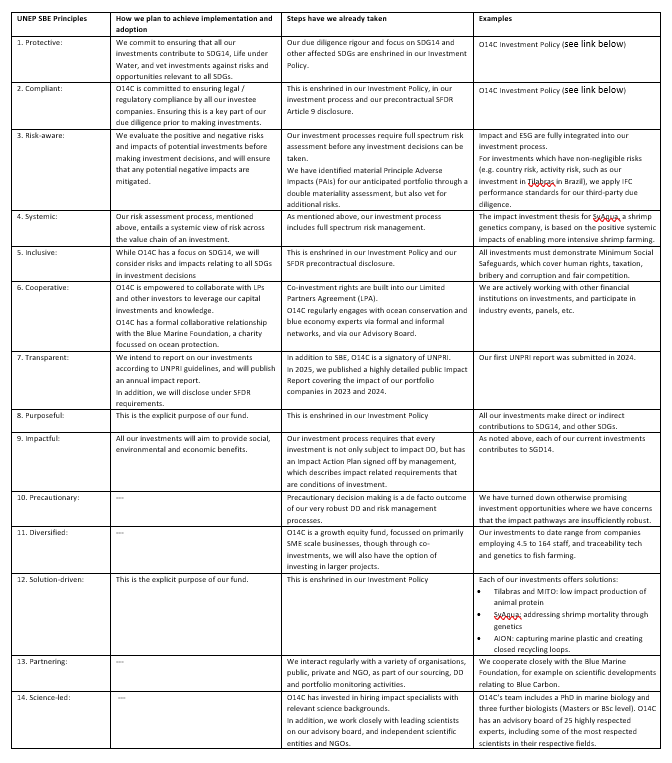

SBE Targets

O14C’s primary SBE-relevant target is that 100% of investments must have quantifiable SGD14 impact. This is a requirement of our investment policy and of our SFDR precontractual disclosures.

In addition, each portfolio company has impact targets, set at the point of investment. Attainment of these targets determines whether 30% of O14C’s carried interest is disbursed to the Fund.

During the due diligence process prior to investment, O14C applies thresholds to manage the risk of an investment causing significant harm. These include:

Exclusions:

- O14C will only make investments that comply with, and where possible exceed, relevant legal and regulatory requirements and, where applicable, international well recognised standards.

- O14C will only make investments where there is alignment with the investee company’s management regarding impact goals.

- O14C will not invest in activities which entail significant risk of harming endangered species.

- The core of O14C’s investment thesis is to identify companies with a strong convergence of impact and commercial drivers. Where no such convergence or potential convergence exists in the company’s business model, O14C does not invest.

Qualitative thresholds:

- For potential impacts such as GHG emissions, where activities with zero emissions are very rare, the O14C’s due diligence ensures that investments are selected which demonstrate, or have the potential to demonstrate, low GHG emissions relative to competing products or services in the given sector.

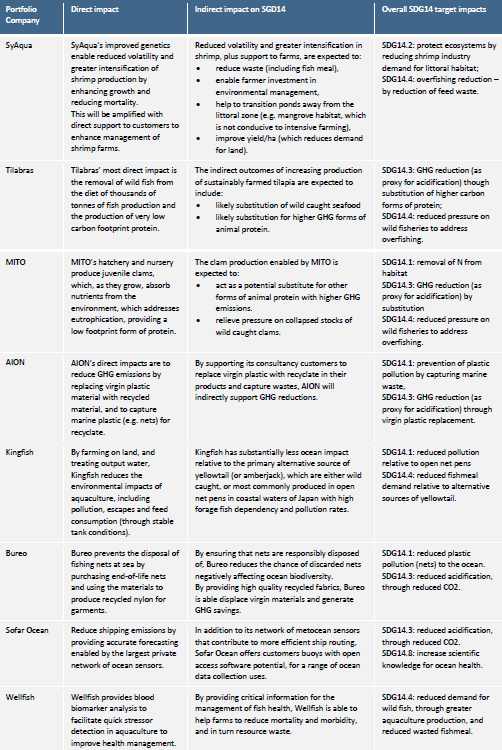

Investments made to date and alignment with SDG14

At the end of 2024, O14C’s portfolio included the following investments, each of which aims to have various positive impacts, including measurable positive impact on SDG14:

Governance – an investment process to deliver sustainable investments

Ocean 14 Capital has put in place mechanisms designed to ensure that investment decisions made by the fund deliver impact. To ensure that the fund invests in sustainable enterprises, O14C has deployed a proprietary evaluation process, which integrates sustainability risks into investment decisions through full-spectrum qualitative and quantitative ESG and impact due diligence, with third party experts as required. Our Impact Committee meets in parallel with our Investment Committee and has a veto on investment decisions.

We monitor the performance of each portfolio company on a continuous basis. O14C will agree an Impact Action Plan (the “IAP”) with every company prior to investment, committing them to actions, targets, monitoring and reporting requirements.

Updates to processes

During 2024 and early 2025, our processes were reviewed updated. The key changes included 1) a revised impact screening tool, incorporating natural capital considerations, 2) additional structured questionnaires on ESG and 3) greater formal responsibility for impact for the deal team leads and analysts, with the impact and ESG team taking a more supporting rather than executive function.

These changes have been reflected in a new ESMS (Environmental and Social Management System), which documents O14C’s full impact and ESG approach.

Click to view Ocean 14 Capital Investment Policy

Click to view Ocean 14 Capital Investment Policy