- Back to NEWS & VIEWS

- In The News

- 05/10/2023

How Sustainable Ocean Funds Are Navigating Impact Measurement

“To get the right metrics you’ve got to go deep into the company’s specific operational pathways. You need to identify the things that generate convergent returns – economic and environmental. It doesn’t work from the top down – it has to be inside out” – George Duffield, Founding Partner, Ocean 14 Capital

Interviews and surveys from leading fund managers shed light on current approaches, common challenges and thoughts on the future.

By Ted Janulis, Helena Janulis and Aly Rose,

Blue economy funds have experienced dramatic growth in the past half decade, with nearly thirty new entrants – ten or so of them in 2022 alone.

This is good news, as it signals both growing investor interest in the sector and an increasing pipeline of investable opportunities. As this ocean investment ecosystem evolves, the question of how to measure impact in investments has become a frequent topic of discussion.

To explore this impact question further, Investable Oceans and CREO conducted interviews and surveyed over a dozen leading sustainable ocean funds from 10 countries.

We supplemented these interactions with reviews of available online resources, including websites and impact reports. We selected funds that already had significant capital under management and are currently investing. The funds collectively captured a diversity of ocean verticals, though notably, 13 out of 14 address Pollution & Waste Management (Figure I).

The discussions were candid and fascinating, and the surveys allowed for additional quantitative analysis. One clear takeaway: all of the funds we spoke with are actively developing strategies – often mapped to SDG 14 – in order to measure and understand impact in ocean investing. Still, there is a strong consensus that much work lays ahead. In this piece, we present our key learnings as well as insights directly from some of the fund managers.

Common Trends

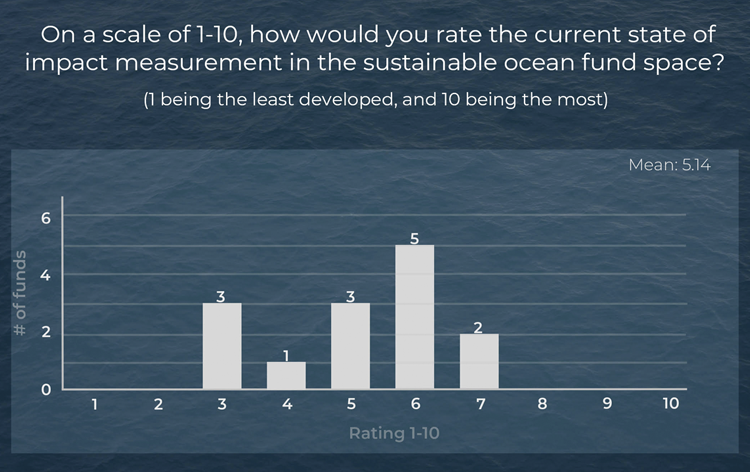

Fund managers agree that impact measurement for sustainable ocean funds is in the early stages of development. Interestingly, half of the survey respondents rate its current state of development at a 6 or 7 out of 10, while the other half rate it at a 3, 4 or 5 out of 10 (Figure II). While impact measurement – and the blue fund/economy space itself – is relatively new, there is great energy, interest and momentum pushing this work forward.

“It took a while for the impact measurement in the blue fund space to get started because of limited investors and track record of investments, limited ocean data and a broad array of investable areas. But in the past few years, with much more investor activity in this space and a focus on carbon reduction it seems to really be taking off. Now we just need more tools to measure biodiversity.” – Amy Novogratz, Co-Founder & Managing Partner, Aqua-Spark

“SWEN Blue Ocean is an Article 9 fund according to the European SFDR regulation, which means 100% of our investments should have impact indicators. We welcome the Ocean Impact Navigator, a set of science-based indicators developed by 1000 Ocean Startups. It provides a shared framework that the ocean innovation community can leverage to accelerate collective impact.” – Christian Lim, Co-Managing Director, SWEN Blue Ocean

A majority of managers also work closely with their portfolio companies to identify impact reporting metrics. Several emphasize the importance of constructive conversations with these companies around metric selection in order to gain a clear understanding of the impact that can be achieved. However, there are differing perspectives among fund managers on the appropriate number of impact metrics; some define 1-5 Key Performance Indicators (KPIs) for each portfolio company, while others reach up to 20 or even 40 KPIs.

“To get the right metrics you’ve got to go deep into the company’s specific operational pathways. You need to identify the things that generate convergent returns – economic and environmental. It doesn’t work from the top down – it has to be inside out.” – George Duffield, Founding Partner, Ocean 14 Capital

As fund managers are working through this process, some are embracing an iterative approach…

“We see every investment as an opportunity to learn about what works – and what doesn’t – when it comes to pursuing near- and long-term outcomes. Toward this end, we work with our partners to articulate the intended impact of their products or services, identify the indicators they use to measure progress toward that impact, and the methods and sources they use to collect indicator data. By asking partners to select impact indicators that will bring the most value to them, we aim to reinforce the link between impact measurement and management and strategy, wherein data is used as an input to critical business decisions.” – Joanna Cohen, Head of Impact Measurement & Management, Builders Vision

To supplement this internal work, some funds engage third-party organizations and impact agencies to help develop frameworks and identify reporting metrics. Among these are consulting firms and NGOs with a deep knowledge of the ocean, such as The Nature Conservancy and the Aquaculture Stewardship Council. A few funds have even created formal advisory groups of internal and external experts across diverse disciplines.

“One of the things that has really been a great help to us from the very beginning is joining The Circulate Initiative’s Impact Metrics Working Group. This group was formed to bring together researchers, experts, advocates and practitioners with different content knowledge relevant to our work – it’s an incredible group. Circulate Capital was able to use the working group as a sounding board for our impact framework – testing our metrics, methodologies, baselines – to really guide how we measure the impact of our investments. Their feedback and guidance has given us the confidence that we’re on the right track.” – Ellen Martin, Chief Impact Officer, Circulate Capital

We also found that the motivations behind developing strategies vary among funds, especially when considering factors such as regulatory compliance, demand from LPs and ties between carry and impact performance. Even though some funds are mandated by regulations and compliance rules, our conversations indicate that personal belief is what primarily drives efforts to create and maintain strategies. This underscores the unique dedication of fund managers to look for investments where sustainable outcomes generate competitive financial returns.

The complexity of the ocean biosphere makes measuring impact difficult; desired data may be unavailable or costly to collect. According to our survey, half of the fund managers struggle with developing impact measurement metrics due to the lack of measurable data. With few exceptions, portfolio companies oversee their own data collection. Several funds have expressed the challenge of selecting the appropriate quantitative metrics for each company to effectively showcase progress toward fund-level goals. This issue has led to a gap between the individuals who require data, such as GPs and LPs, and those who are responsible for collecting it.

While efforts like the OIN are attempting to standardize metrics for sustainable ocean funds, each individual fund still maintains its own unique set of metrics. This can create confusion for startups receiving investments from multiple ocean funds and raises the question: How would implementing a standardized menu of metrics and conversion rate affect the sector’s ability to assess the dollar value of these investments? Measuring a startup’s output indicators or return on investment is easy but translating the data into a quantifiable “return on impact” is much more challenging. Establishing a standard for determining the actual cost of factors, such as a kilogram of plastic in the ocean or fertilizer leakage, could include the expenses of cleaning up or savings generated by preventing such occurrences.

“It is imperative that startups and funders align on a standard framework to measure and report positive ocean impact outcomes. Standardized ocean impact metrics will allow us all to address these ocean challenges more efficiently. While it may be challenging to create a standard impact framework, it’s achievable if we start by first working with startups to understand the type of raw impact data they can collect, and then build a framework grounded in science that prominent funders can use to align reporting requirements for their portfolios.” – Craig Dudenhoeffer, Chief Impact Officer & Investments Officer, Sustainable Ocean Alliance

Although funds recognize the value of standardizing frameworks, impact measurement poses different challenges depending on the specific verticals within the blue economy. Funds have found it easier to measure impact in investments related to ocean-related energy solutions, while it is more difficult in aquaculture, fisheries, and ocean intelligence/data solutions. Ocean CDR and ecosystem restoration fall somewhere in-between. Some frameworks suggest using qualitative metrics in the more challenging sectors, but there is concern about the credibility of such metrics.

“Faber’s fund strategically covers blue biotech, food & feed, decarbonization of shipping, ocean intelligence, desalination, and ocean-related energy. From an impact management perspective, some areas are more straightforward than others. In general, enabling technologies with a direct positive impact on CO2 emissions, such as clean energy, have metrics easier to measure and monitor. Others, like blue biotech, with an impact on complex industrial value chains, or ocean intelligence, with an indirect impact on biodiversity, can be more challenging. Access to data is key.” – Rita Sousa, Partner at Faber Ocean/Climate Tech Fund

While funds are clearly investing time and effort to develop proprietary strategies, numerous managers expressed a genuine interest in harmonizing approaches. The alignment of funds on impact measurement has the potential to facilitate the flow of much needed capital to accelerate the transition to a sustainable blue economy.

Ted Janulis is Founder & Principal at Investable Oceans, an ocean investment hub that accelerates market-based sustainable ocean investing across all asset classes and sectors of the Blue Economy. Over a 35+ year business career, Ted has served in various executive positions, including CEO, at financial institutions involved in Capital Markets, Banking and Asset Management. He is President Emeritus of The Explorers Club in New York City and serves on numerous for-profit and not-for-profit boards, including Gannett Co Inc, Ocean Risk and Resilience Action Alliance (ORRAA), One Ocean Foundation and Duke University’s Nicholas School of the Environment Board of Visitors.

Aly Rose is Sector Manager of Oceans & Aquaculture at CREO Syndicate, a 501(c)3 think-and-do tank working with a network of ultra-high-net-worth family offices leveraging private capital to invest in climate solutions providing a more sustainable future. Prior to her role at CREO, Aly worked at SeaAhead, where she helped manage the Blue Angels Investment Group, served on the working group for 1000 Ocean Coalition’s Ocean Impact Navigator, and helped incorporate IMM strategies for startups into SeaAhead’s BlueSwell Incubator curriculum. Aly holds a bachelor’s degree in Comparative Policy, Environmental Studies, and Spanish from Bowdoin College, a Master’s Degree in Spanish Linguistics from Middlebury College, and a Master’s Degree in Climate Change and Sustainability Policy from Northeastern University.

Helena Janulis is the Business Development & Special Projects lead at Investable Oceans, and the COP28 Ocean Pavilion Associate Project Manager at Woods Hole Oceanographic Institution. She holds an Environmental Master’s Degree from the University of Colorado Boulder, a bachelor’s degree in marine science from the University of Hawai’i Hilo, and a Project Management Certificate from Cornell University. Prior to her work in ocean finance, Helena was a consultant for Outside Magazine, a B Corp Certification consultant for a tempeh company in Boulder, and a Divemaster in Hawai’i. She is a long-term member of The Explorers Club in New York City and the Committee Chair for the Club’s Rising Explorers Grant.